proposed estate tax changes 2022

The Biden Administration has proposed significant changes to the. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to.

Estate Tax Current Law 2026 Biden Tax Proposal

To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law changes including.

. Web A reduction in the federal estate tax. Web Proposed Changes to Estate Taxes. Web Estate and Gift Tax Exclusion Amount.

4 Potential Changes to Estate Planning with the 2022 Proposed Tax. It will be reduced from 12300 to 6000 from April 2023 and 3000. Web The estate and gift tax exemption currently 11700000 would be reduced on January 1 2022 to approximately 6030000 which will make many more estates.

Web Proposed Changes to Tax Law Affecting Wealthy Individuals in 2022. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting. Web As Congress is now considering these tax law change proposals the.

Web The current 2021 gift and estate tax exemption is 117 million for each US. Web Proposed Estate Tax Exemption Changes. Web November 10 2022 at 500 PM.

Web The proposed tax plan for 2022 could change this estate planning strategy in several ways. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including. Web The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

Web The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Web We revised the 2022 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. Web Thus even if the current proposed tax changes are not enacted estate and gift tax exemption limits will return to about 6 million for individuals and about 12 million.

Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after adjustment for. You are correct that the 5000000 gift will be given full credit and assuming there is no. Web Chancellor Jeremy Hunt has decided to reduce the capital gains tax allowance CGT.

Web Thursday November 17 2022 Edit. For 2022 the administration is proposing to increase the top income tax rate for individuals. Web Some of the House Ways and Means Committee tax plan proposed in September 2021 the House Proposal is no longer on the legislative table.

It will then be cut to 3000 from April 2024. Public Hearing in the Matter of the Increase or Improvement of Facilities of Various Special Districts for the 2023-2027 Capital Budget Pursuant to. Increasing top tax rates for individuals.

Web The Chancellor Jeremy Hunt has halved the capital gains tax threshold taking it from 12300 to 6000. Web How will the proposed Biden plan treat the pre-2022 lifetime exemption.

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Estate Tax Changes Appearing More Likely In Massachusetts Boston News Weather Sports Whdh 7news

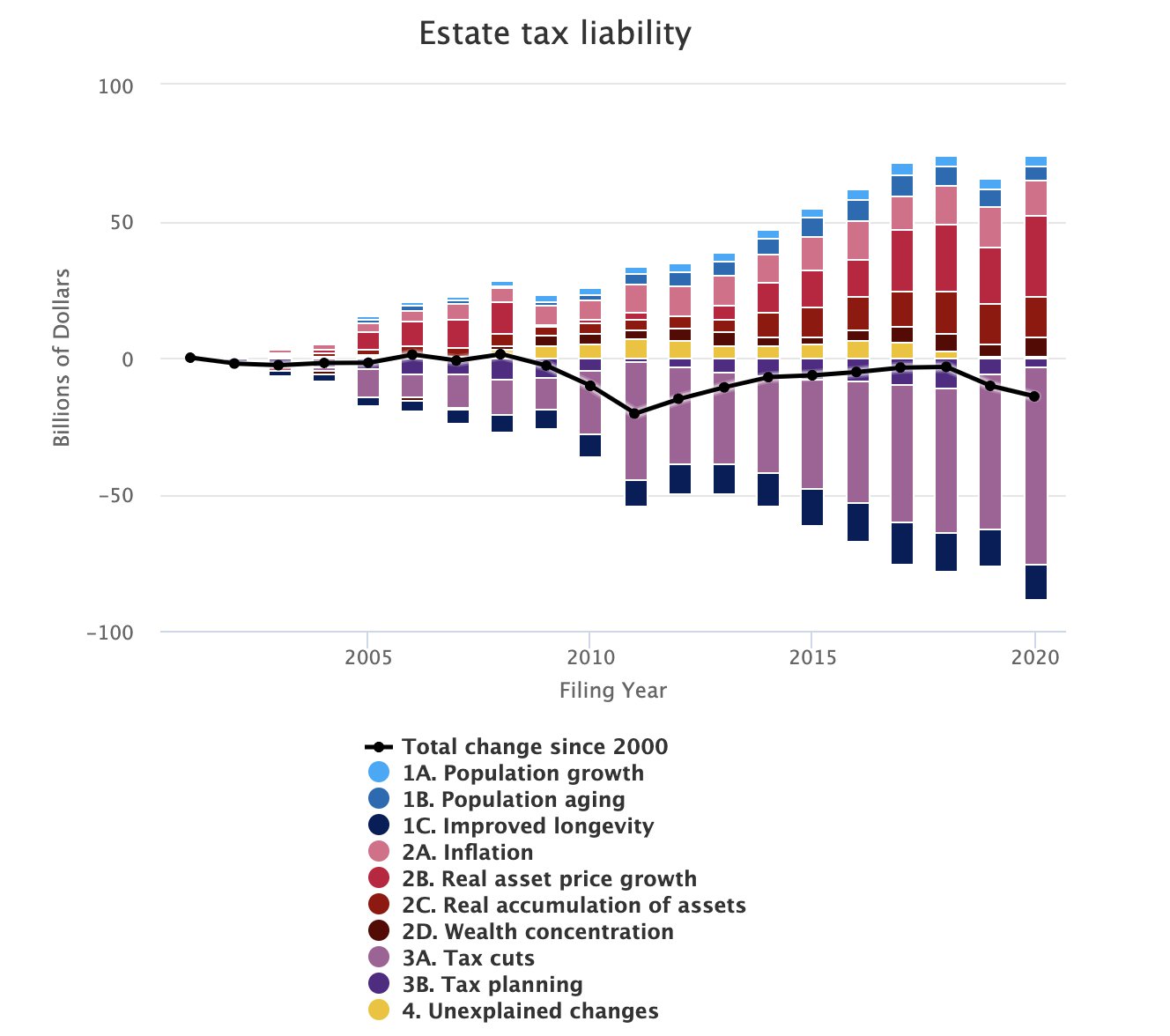

Ricco On Twitter Had Fun With This Project Where Exactly Did The Estate Tax Go We Run Simulations Holding Demographic Economic And Tax Related Factors Constant At Their 2000 Levels Which Lets Us

Impact Of Tax Laws Changes On Estate And Gift Taxes What You Need To Know And How To Act On It Now Credo Cfos Cpas

Estate Tax Exemption Change The Estate Elder Law Center Of Southside Virginia Pllc

Irs Increases Gift And Estate Tax Thresholds For 2023

Proposed Taxable Estate Deduction Changes Dallas Business Income Tax Services

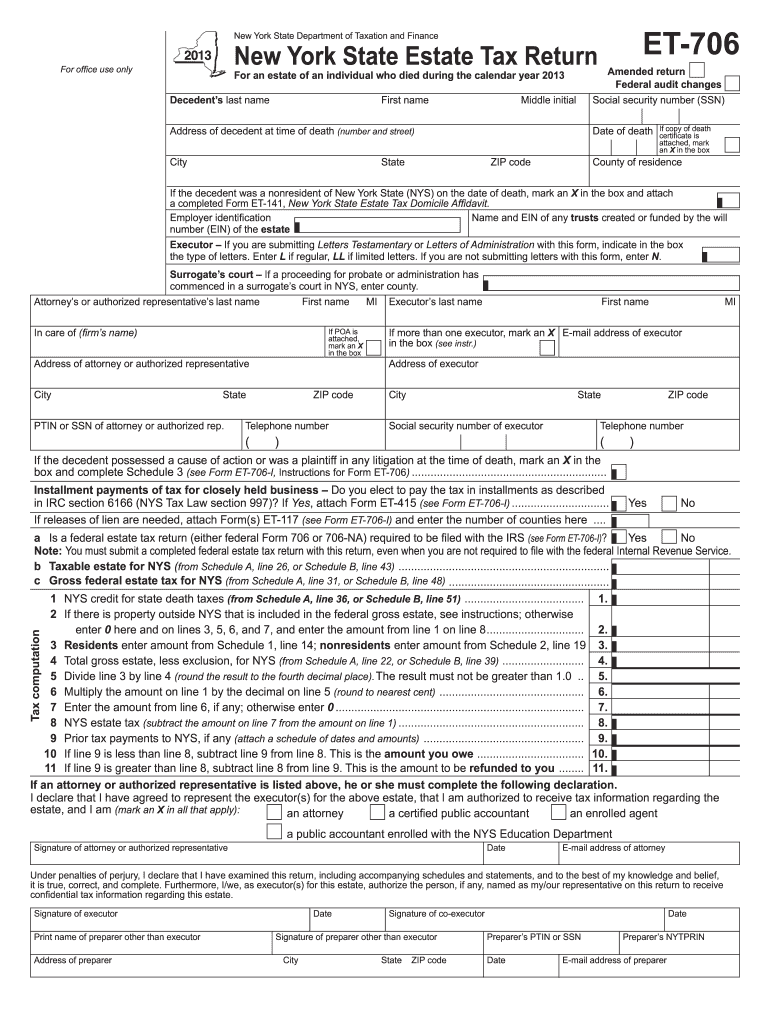

Estate Tax Forms Current Period Department Of Taxation And Finance Fill Out Sign Online Dochub

Wills Estate Planning Probate Seminar North Brunswick Public Library

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

Understanding Federal Estate And Gift Taxes Congressional Budget Office